No products in the cart.

0

Any donation above $2 is 100% tax deductible!

Any donation above $2 is 100% tax deductible!

Secure & encrypted donations

Zakat Al-Mal is an obligatory charity which is a duty upon every abled Muslim. 2.5% of a Muslim accumulated wealth calculated yearly, and the proceeds should be distributed among the poor and needy, more specifically saying distributed to the eight eligible groups who can obtain zakat.

Your donations reach the poor in FULL, no hidden fees.

As part of our promise, we do not take or charge any admin fee.

It’s important for us to protect your personal information.

We offer complete transparency in everything we do.

Read the answers for most asked questions by our donors

Zakat Al-Mal is an obligatory charity which is a duty upon every abled Muslim. 2.5% of a Muslim accumulated wealth calculated yearly, and the proceeds should be distributed among the poor and needy, more specifically saying distributed to the eight eligible groups who can obtain zakat.

The Quran emphasises on the necessity of giving zakat at multiple accounts.

“Righteousness is not that you turn your faces toward the east or the west, but [true] righteousness is [in] one who believes in Allah, the Last Day, the angels, the Book, and the prophets and gives wealth, in spite of love for it, to relatives, orphans, the needy, the traveler, those who ask [for help], and for freeing slaves; [and who] establishes prayer and gives zakah; [those who] fulfill their promise when they promise; and [those who] are patient in poverty and hardship and during battle. Those are the ones who have been true, and it is those who are the righteous.” (Quran 2:177)

Zakat Al-Fitr has to be given by the head of the family before the start of the Eid-prayer, to the poor and less privileged. This is to ensure that all Muslims celebrate a hunger free Eid filled with happiness and contentment. The local food or wheat is generally used as a measure in giving Zakat Al-Fitr.

This is a type of voluntary charity. Sadaqah is referred to as any act of kindness done by one Muslim to another, be it smiling or financial support for their daily living etc. It is a form of charity that is not restricted to the rich only, but any Muslims can perform Sadaqah in ways that they can.

Prophet (Peace Be Upon Him) said, “Every Muslim has to give in sadaqah (charity).” The people asked, “O Allah’s Messenger (saw)! If someone has nothing to give, what will he do?” He said, “He should work with his hands and benefit himself and also give in charity (from what he earns).” The people further asked, “If he cannot do even that?” He replied, “Then he should help the needy who appeal for help.” Then the people asked, “If he cannot do that?” He replied, “Then he should perform all that is good and keep away from all that is evil and this will be regarded as charitable deeds.” (Bukhari)

Zakat has to be paid when one lunar year (hawl) has passed, starting from the day your wealth exceeds the nisab (the minimum amount a Muslim must have before being obliged to pay Zakat/Zakah). It can be paid at any time of the year, but it should not exceed more than one hawl. It is always a good idea to have a specific date to pay Zakat so that you do not miss out on this duty.

Zakat is calculated by deducting 2.5% of your combined wealth.

This includes currency, gold and silver, and trade goods.

If one has agriculture or livestock in their possession, then they must also pay Zakat to cover those possessions.

It is important to note that Zakat on livestock and agriculture is different from the Zakat on individuals.

Sadaqah is a voluntary charity that is a general donation of any amount which is encouraged to be given throughout the year and especially in Ramadan.

Zakat, on the other hand, is an obligatory charity donation that is income-based which must be performed by all Muslims that qualify to pay Zakat.

Here are a few differences between Zakat and Sadaqah:

Zakat is important for many reasons. Firstly Zakat is a Pillar of Islam and if one has sufficient wealth and does not fulfil their obligation of paying their Zakat then they are committing a major sin.

Zakat is the right of the poor and needy Muslims. By paying your Zakat you are helping the lower and middle classes of society which raises economic activity and productivity and reduces poverty which in turn helps in the redistribution of wealth.

Through Zakat, Allah also blesses your wealth and causes it to grow.

Zakat administrators are those who collect and distribute Zakat on behalf of the Muslim community. They are subject to Shariah guidelines and they are responsible for distributing the wealth as per the Shariah guidelines of distribution.

Zakat administrators are allowed to take a percentage of the Zakat to cover the expenses of their operations.

“Zakah expenditures are only for the poor and for the needy and for those employed for it1 and for bringing hearts together [for Islam] and for freeing captives [or slaves] and for those in debt and for the cause of Allah and for the [stranded] traveler – an obligation [imposed] by Allah. And Allah is Knowing and Wise. (Quran 9:60).

We are an Australian charity with our head office in Sydney.

Through our appeals, we help many people who are eligible to receive Zakat in;

Afghanistan, Albania, Bangladesh, Indonesia, Iraq, Kashmir, Lebanon, Nigeria, Pakistan, Palestine, Rohingyas, Somalia, Sri Lanka, Syria, Turkey, Uyghurs and Yemen.

Besides one’s monetary wealth there are certain things that Muslims may possess that they need to pay Zakat for such as:

Once you have paid your Zakat online, Merciful Group places the money into a special holding account designated only for Zakat.

Zakat donations are then distributed according to the strict Sharia Guidelines on who is eligible to be given that Zakat.

Merciful Group, 100% of your Zakat is donated towards the most in need, providing vital food packages not only in Ramadan but throughout the year to the poorest countries around the world.

Merciful Group is an Islamic charity that delivers Zakat and Sadaqah transparently to those who need it most.

We launch appeals for emergency situations in over 15 Countries.

Zakat is to be given to 8 categories that Allah SWT has mentioned in the Holy Quran.

“Zakah expenditures are only for the poor and for the needy and for those employed for it1 and for bringing hearts together [for Islam] and for freeing captives [or slaves] and for those in debt and for the cause of Allah and for the [stranded] traveler – an obligation [imposed] by Allah. And Allah is Knowing and Wise.” (Quran 9:60)

One of the main conditions of zakat is that the recipient must be Muslim. Merciful Group ensures that all recipients of Zakat are Muslims.

Zakat may be given to one’s relatives if they fall under the category of “poor persons”. Meaning they do not have enough to suffice themselves for a whole year or if they have debts which resulted in them not having sufficient resources.

Zakat may be given to orphans as well if they have debts and/or they come under the category of poor persons. If the orphans are now of working age and they can work for themselves and they have sufficient wealth, then giving Zakat to them is not permissible.

Zakat may also be given to somebody who is in need of medical treatment only if they are eligible to receive Zakat.

Water Wells are not Zakat eligible. A condition of zakat is ownership, it is not possible for a water well to have an owner. Merciful Group does not build water wells using zakat money. Instead, we only use Zakat donations towards food programs for the poor and needy Muslims.

Zakat money may not be given to Mosques/Masjids. Zakat may not be given towards the building of a Mosque or Masjid.

Zakat may not be given to your family if you have an Islamic duty to care for them.

For example, your Zakat cannot be given to your wife as you have an Islamic duty to care for her that already exists. For relatives who you are not obligated to provide for, you may pay zakat if they fall under the category of a poor person.

This option includes all items in a food pack + Hygiene pack

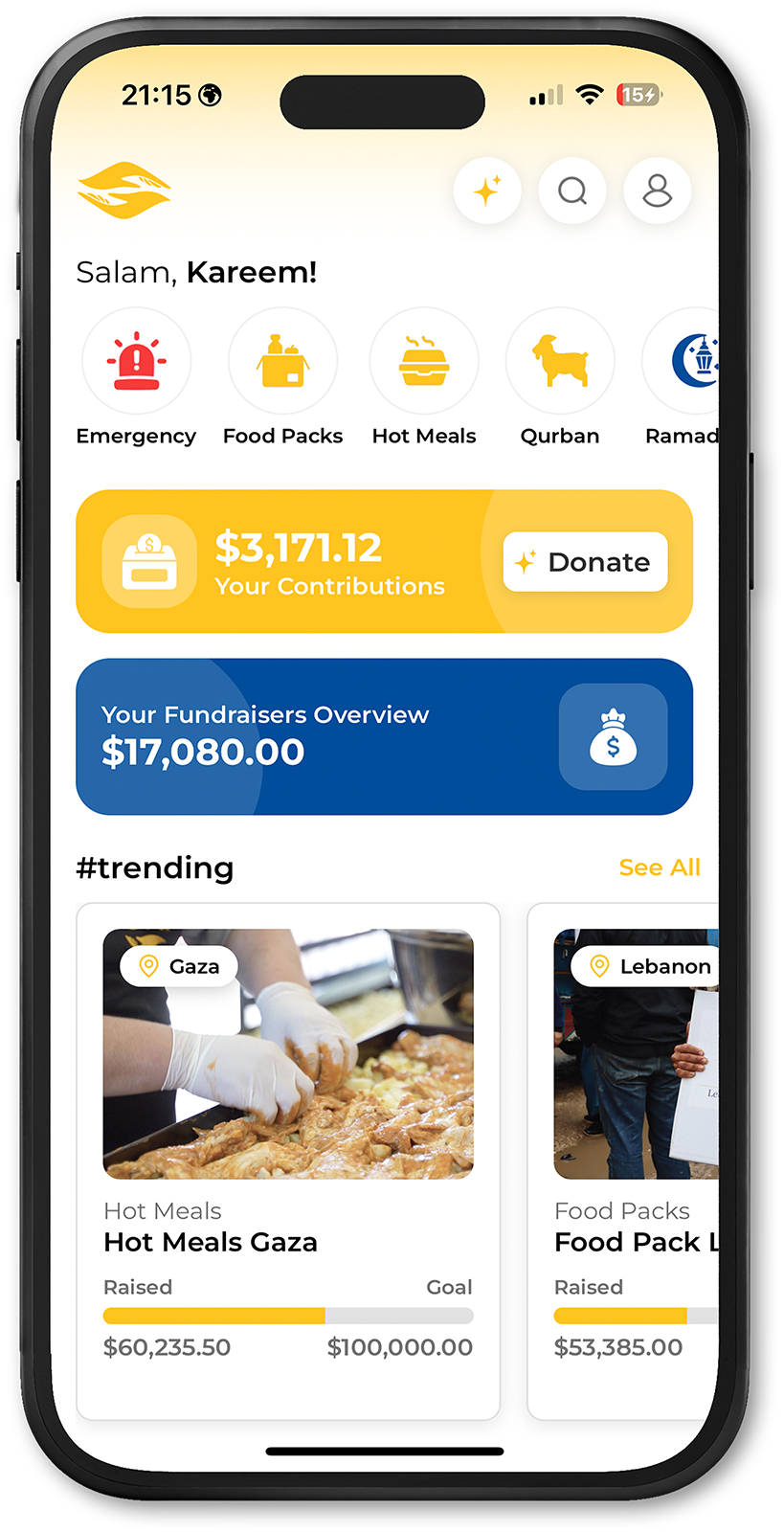

A better way to give, track, and manage your donations—all in one place.